9 Simple Techniques For Guided Wealth Management

9 Simple Techniques For Guided Wealth Management

Blog Article

Some Known Details About Guided Wealth Management

Table of ContentsHow Guided Wealth Management can Save You Time, Stress, and Money.The Ultimate Guide To Guided Wealth Management6 Simple Techniques For Guided Wealth ManagementSome Known Details About Guided Wealth Management The Ultimate Guide To Guided Wealth Management

For more ideas, see track your financial investments. For financial investments, make payments payable to the product company (not your adviser) (super advice brisbane). Consistently inspect purchases if you have a financial investment account or make use of an investment system. Providing a financial consultant total accessibility to your account boosts danger. If you see anything that doesn't look right, there are actions you can take.If you're paying a recurring suggestions cost, your adviser needs to evaluate your financial circumstance and consult with you a minimum of annually. At this meeting, see to it you discuss: any type of modifications to your goals, circumstance or funds (consisting of modifications to your revenue, expenditures or assets) whether the level of risk you're comfortable with has transformed whether your current personal insurance coverage cover is right just how you're tracking versus your goals whether any kind of modifications to regulations or monetary products might affect you whether you've obtained every little thing they guaranteed in your contract with them whether you require any kind of modifications to your plan Annually an advisor should seek your written consent to bill you recurring recommendations costs.

This may happen during the meeting or digitally. When you enter or renew the ongoing charge plan with your consultant, they need to describe exactly how to finish your relationship with them. If you're relocating to a new advisor, you'll require to arrange to transfer your monetary records to them. If you require assistance, ask your advisor to explain the procedure.

The Greatest Guide To Guided Wealth Management

As a business owner or little company owner, you have a lot going on. There are lots of responsibilities and costs in running an organization and you certainly do not need an additional unnecessary expense to pay. You require to thoroughly take into consideration the return on financial investment of any type of solutions you obtain to ensure they are beneficial to you and your business.

If you're one of them, you might be taking a significant threat for the future of your company and on your own. You may intend to continue reading for a list of reasons that employing an economic advisor is advantageous to you and your service. Running an organization is complete of obstacles.

Money mismanagement, cash money circulation issues, delinquent payments, tax obligation concerns and various other monetary problems can be critical sufficient to close a service down. There are several methods that a qualified financial consultant can be your partner in aiding your service flourish.

They can deal with you in evaluating your financial scenario often to avoid major blunders and to rapidly deal with any kind of negative cash decisions. Many little organization proprietors put on several hats. It's easy to understand that you want to save cash by doing some work on your own, but handling funds navigate to this site takes knowledge and training.

Guided Wealth Management - Questions

You need it to understand where you're going, just how you're getting there, and what to do if there are bumps in the road. A great economic advisor can put with each other a detailed strategy to aid you run your company more successfully and prepare for abnormalities that develop.

A reputable and knowledgeable economic consultant can guide you on the investments that are appropriate for your business. Cash Savings Although you'll be paying a monetary advisor, the lasting financial savings will certainly validate the cost.

It's all concerning making the best monetary decisions to increase your chances of success. They can guide you towards the ideal possibilities to raise your revenues. Lowered Tension As a local business owner, you have lots of things to stress over (retirement planning brisbane). A great monetary consultant can bring you satisfaction knowing that your finances are getting the attention they need and your money is being spent sensibly.

The Facts About Guided Wealth Management Revealed

Stability and Growth A qualified monetary expert can offer you clarity and aid you focus on taking your company in the ideal direction. They have the tools and sources to use tactics that will certainly guarantee your service grows and grows. They can aid you evaluate your objectives and establish the very best path to reach them.

Guided Wealth Management Fundamentals Explained

At Nolan Accountancy Facility, we offer know-how in all aspects of financial preparation for small companies. As a small company ourselves, we understand the obstacles you deal with each day. Provide us a phone call today to review how we can help your business flourish and do well.

Independent possession of the technique Independent control of the AFSL; and Independent compensation, from the customer only, by means of a set buck fee. (https://www.cybo.com/AU-biz/guided-wealth-management)

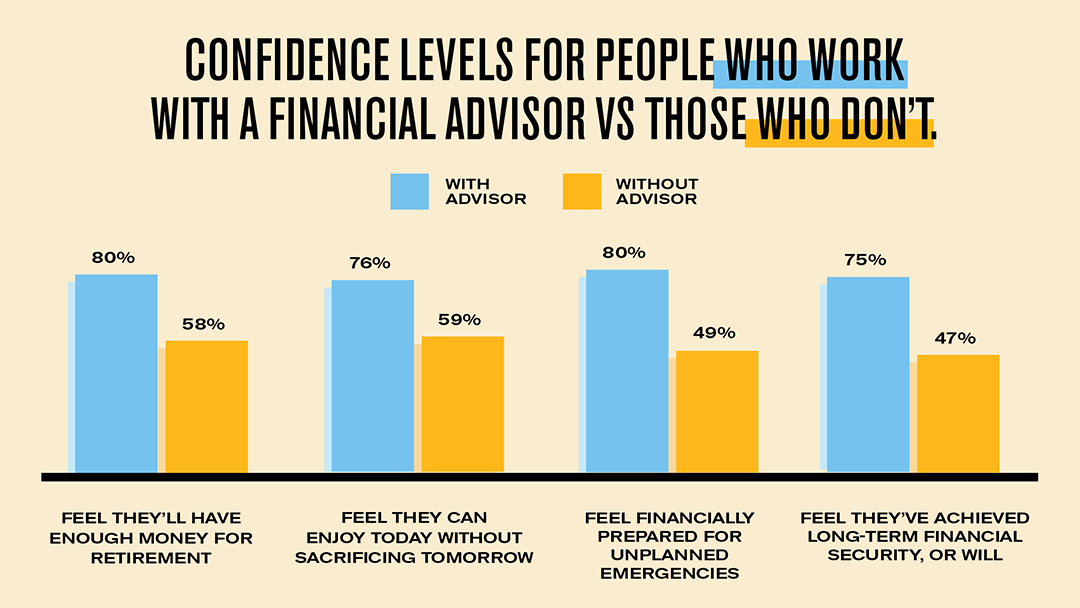

There are countless benefits of a financial coordinator, no matter of your situation. Despite this it's not unusual for people to second hunch their viability due to their position or present investments. The aim of this blog site is to confirm why everybody can take advantage of an economic plan. Some typical issues you may have felt on your own consist of: Whilst it is very easy to see why people may think by doing this, it is certainly wrong to deem them correct.

Report this page